When purchasing a home, it’s important to understand the various financial components involved, especially the impact of closing costs.

One key aspect is the “cash to close,” which represents the total amount of money you’ll need in the bank to finalize your home purchase with a mortgage. Within this cash to close, closing costs play a significant role. These are fees directly tied to the real estate and loan transaction itself, encompassing items like lender fees, appraisal and credit report costs, title search and insurance, attorney fees, and settlement or recording fees. Additionally, cash to close can include prepaids (escrow money set aside for property taxes and sometimes insurance) and reserves (a set number of monthly payments some programs require for post-closing liquidity). Understanding these closing costs is crucial for a smooth home-buying process.

Florida closing costs

What Are Closing Costs in Florida?

Closing costs in Florida are fees paid at real estate closing, typically 2-5% of purchase price for buyers ($20,000-$50,000 on a $1’000,000 home). These one-time charges cover loan processing, title insurance, taxes, and various third-party services required to finalize your property transaction. Understanding these costs is crucial whether you’re buying your first home or investing in Florida real estate.

How Much Are Closing Costs in Florida?

Estimated Florida Closing Costs by Transaction Type on a $1,000,000 home:

- Buyers: $20,000–$50,000 (2–5%)

- Sellers: $40,000–$50,000 (4–5%)

- Cash Buyers: $10,000–$20,000 (1–2%)

- Refinancing: $20,000–$30,000 (2–3%)

Key Fact: For current market rates that affect your closing costs, check our current mortgage rates page.

Who Usually Pays What? Complete Closing Costs Breakdown

Estimated Buyer’s Closing Costs: Four Main Categories

1. Origination Charges:

- 0% – 2% of loan amount

- Underwriting fees: $900 – $1,500

2. Services You Cannot Shop For:

- Appraisal fee: $500-$1,000

- Credit report fee: $95

- Misc. Fees: $100-$200

3. Services You Can Shop For:

- Title insurance: 0.6% of the purchase price

- Title search: $150-$400

- Title settlement: $950

- Survey fee: $350-$500

- Attorney fees: $1,000-$2,000 (in some cases)

4. Taxes and Government Fees:

- Recording fees: $200-$250

- Doc stamp tax: $0.70 per $100 (on mortgage)

- Transfer taxes: Varies by county

For a detailed breakdown of property taxes across Florida counties, visit our comprehensive Florida property tax guide.

Seller’s Closing Costs: Primary Components

Transaction Fees:

- Real estate commission: 4-6% of sale price

- Documentary stamps on deed: $0.70 per $100

- Owner’s title insurance ( if applicable) : ~$2 per $1,000

- Seller’s attorney fees: $500-$1,000

Estimated Pre-Paid Items at Closing (in addition to transaction closing costs)

Based on Loan Programs, Pre-Payments:

- Homeowner’s insurance: 12 months upfront

- Property taxes: 3-12 months in escrow

- Prepaid interest: Daily rate × days until first payment

- HOA fees: If applicable (varies widely)

- Flood insurance: If required.

How to Estimate your Closing Costs

Step-by-Step Calculation Method:

- Start with purchase price (e.g., $1’000,000)

- Multiply by 2-5% for rough estimate ($20,000–$50,000)

- Add loan-specific fees:

- Conventional: PMI if <20% down

- Non-QM, posible origination fees

- International Buyer, origination fees

- FHA: +1.75% upfront MIP

- VA: +0-3.3% funding fee

- Add pre-paids

- Subtract any seller concessions (if negotiated)

Pro Tip: Request a Loan Estimate within 3 days of application for exact figures. Use our mortgage calculator to estimate your monthly payments including closing costs amortized into your loan.

3 Proven Strategies to Reduce Florida Closing Costs

- Negotiate seller concessions (between 3 -6%)

- Shop multiple service providers (save $500-$1,500)

- Time your closing strategically (end of month reduces prepaid interest)

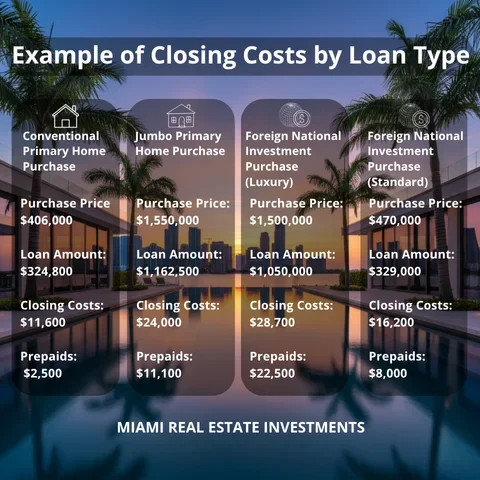

Example of Closing Costs by Loan Type: Complete comparison by program, borrower type, and preferences

Conventional Primary Home Purchase

- Purchase Price: $406,000

- Loan Amount: $324,800

- Closing Costs: $11,600

- Prepaids: $2,500

Jumbo Primary Home Purchase

- Purchase Price: $1,550,000

- Loan Amount: $1,162,500

- Closing Costs: $24,000

- Prepaids: $11,100

Foreign National Investment Purchase

- Purchase Price: $1,500,000

- Loan Amount: $1,050,000

- Closing Costs: $28,700

- Prepaids: $22,500

Foreign National Investment Purchase

- Purchase Price: $470,000

- Loan Amount: $329,000

- Closing Costs: $16,200

- Prepaids: $8,000

Explore our specialized investment property loan programs designed to minimize closing costs for investors.

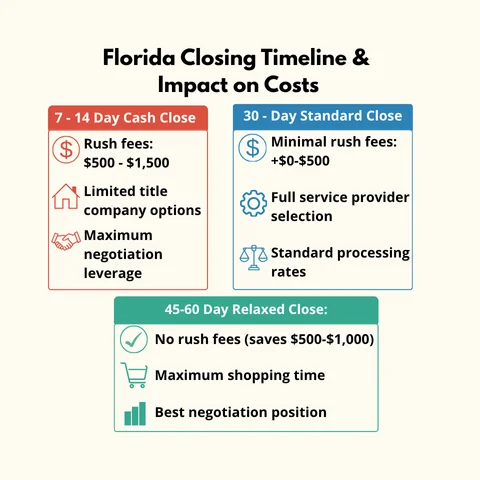

Florida Closing Timeline Impact on Costs

Florida closing Timeline

Timeline Options and Cost Implications:

7-14 Day Cash Close:

- Rush fees: +$500-$1,000

- Limited title company options

- Maximum negotiation leverage

30-Day Standard Close:

- Minimal rush fees: +$0-$500

- Full service provider selection

- Standard processing rates

45-60 Day Relaxed Close:

- No rush fees (saves $500-$1,000)

- Maximum shopping time

- Best negotiation position

Still have questions about Florida closing costs?

Still have questions about Florida closing costs?

Check out this short, easy-to-follow video that breaks it all down in seconds.

Watch it now and feel like a pro when it comes to closing!

Strategies to Reduce Closing Costs

Don’t be afraid to negotiate your closing costs. Many of these costs are negotiable, and you might be surprised at how much you can save by simply asking for a discount.

In some cases, you can negotiate with the seller to cover a portion of your closing costs. This is known as seller concessions.

Also, don’t settle for the first lender or service provider you come across. Shop around and compare offers to find the best deals on closing costs.

See our closing cost example below to get familiar with the terms we explained in this article.

Download Estimated Fee WorksheetFrequently Asked Questions

What’s included in Florida closing costs?

Florida closing costs include among possible others:: loan origination fees, appraisal, title insurance, recording fees, taxes, and prepaid items like insurance and property taxes.

Are closing costs negotiable in Florida?

Yes, some closing costs are negotiable including: title services, and seller concessions, potentially saving $2,000-$5,000.

When do I pay closing costs in Florida?

Closing costs are due at the closing table via certified check or wire. Some fees like inspection ($300-$500) and appraisal ($400-$700) are paid earlier.

Can closing costs be rolled into my mortgage?

Most closing costs cannot be financed, except VA funding fees and FHA upfront MIP. No-closing-cost loans trade higher rates for paid fees.

Do cash buyers pay closing costs?

Yes, cash buyers pay 1-1.5% in closing costs, including title insurance, transfer taxes, and recording fees.

How can I estimate my closing costs?

Calculate 2-5% of purchase price, then request a Loan Estimate from your lender for exact figures within 3 days of application.